On 20 April 2010 a British Petroleum oil platform in the Gulf of Mexico exploded, killing 11 men and spilling an estimated 172 million gallons of crude oil into the sea. A disaster similar to the Exxon Valdez spill 21 years ago?

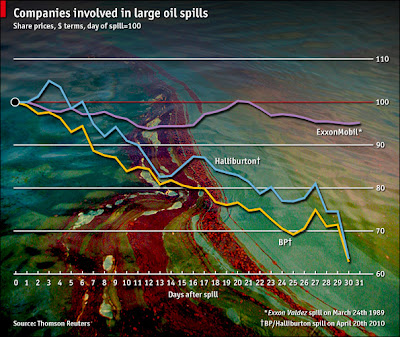

Let’s go back to 1989. The Exxon Valdez, an oil tanker owned by ExxonMobil (then still known as Exxon), crashed into a reef nearby Alaska and spilled approximately 11 million gallons. Exxon’s stock price fell slightly (by 7%) in the first weeks after the accident but it soon bounced back and ended with a 7% profit.

Investors who thought BP shares would react similar were wrong. After the news of the explosion, BP’s share price sharply dropped and after one month it was only worth a third of its value before the spill.

Another notable fact is that the fall in market value is not only due to estimated costs for cleaning and punishments, which had been the case with other environmental disasters such as the Exxon Valdez spill. BP’s market value decreased with 65 billion, when estimated costs are only 30 billion. This difference is probably due to a damaged reputation, especially because BP was known as one of the most ‘green’ oil companies (compared to ExxonMobil, Shell,..). This would be the first time an environmental accident would have such an impact on a company’s reputation and therefore also on its market value.

Sander Van Ouytsel

I think this comparison between BP and Exxon is useful because it gives us an example of two companies whose stoke prices reacted differently after a similar event. Off course we can’t deny that BP’s oil spill is one of a much bigger scale than Exxon’s spill. But that’s not the only reason why BP’s share prices dropped so sharply; we are now living in a completely different time, where damage to the environment has become a very important topic.

BeantwoordenVerwijderenMany people invest based on experience on historical data. However this is a good way to look how markets reacted in similar situations, hoping BP’s share price would do the same now as Exxon’s in 1989 probably is wishful thinking.

This article also gives an example of how quick a share price can change when something happens no one could forecast. On 19 April investing in BP seemed a good choice, while a day later it would have been the worst investment you have ever made.

Sander Van Ouytsel